There is increasing clamour around “Industry 4.0” with the main protagonists telling whoever will listen that UK companies must either adopt the principles or get left behind. For many SMEs however, there just isn’t compelling proof of the potential benefits that their company could receive from investing in digitisation, automation and integration.

Seeing is believing!

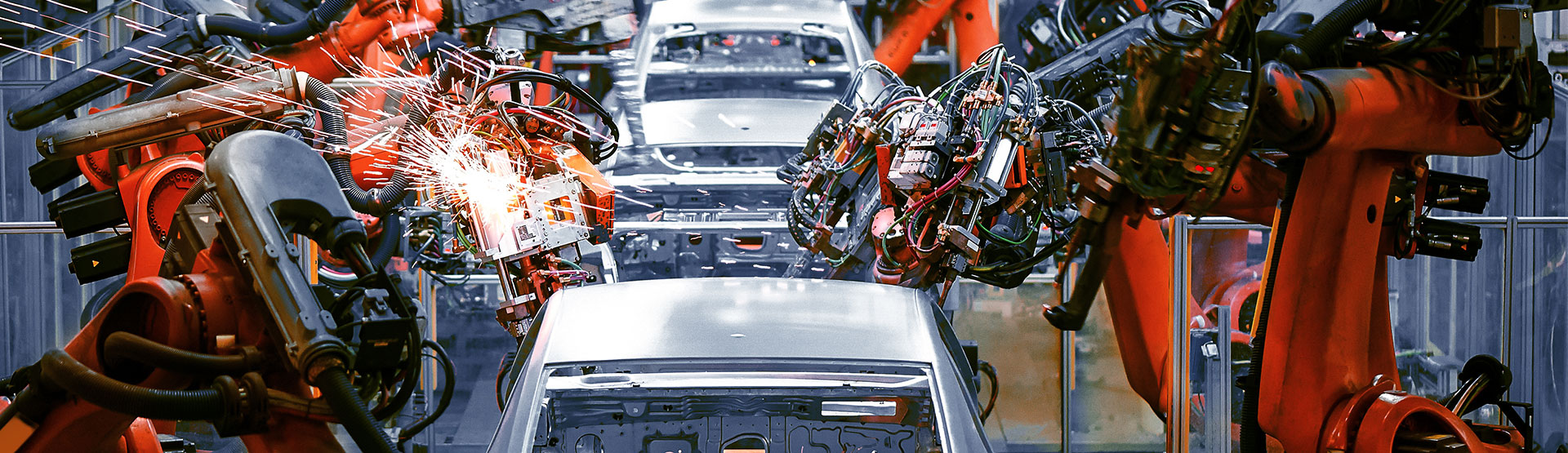

Graham Beck, mechanical engineering analyst at R&D tax relief specialist Jumpstart, shares practical, real life examples of savvy businesses which have reaped short-term benefits from process innovation projects, one of the pillars of Industry 4.0

Process innovation

Process innovation isn’t a new concept. It’s been around since at least the rise of industrial factories in the 17th century, when mill owners recognised the economies of scale created by having individual operators focusing on specific tasks within the manufacturing process and as result creating the now ubiquitous process lines.

Nowadays companies pursue process innovation projects for lots of different reasons.

Some companies are looking to reduce waste in the manufacturing process or maybe they’re adopting a zero defects culture, as is common in a lot of supply chain development programmes.

How one such company has benefited from process innovation

With a turnover of £3.2million, this company is involved in CNC machining of plated components. The team was seeking to significantly reduce waste and improve finished product quality. Project work involved investigating alternative plating techniques, trialling new combinations of basecoats and flashes and redesigning components to reduce damage in the process line. The company achieved a substantial reduction in waste levels and increased the quality of finished components. Success!

And, as an added “cherry on the cake” all of the above project activities made the company eligible for R&D tax relief, and they were able to realise a substantial £256,000 tax benefit! Double success!

Manufacturing efficiency yields lucrative results

Other companies may be looking for more general gains in manufacturing efficiency, such as reduced process time or improved longevity of manufacturing equipment and reduced energy consumption.

One company that enjoyed such significant benefits is an engineering business, focused on forging automotive components. The company was looking to reduce cycle times and waste by improving the automated lubrication of dies. This involved experimenting with a range of graphite-based lubricants, varying spray heads and spray patterns. The project successfully saw a 10% increase in die life span, a 5% reduction in forging cycle time, 2% reduction in scrap, 9% increase in overall equipment effectiveness AND a 5% power saving as a result of being able to reduce forging temperatures and reducing the power used in drop presses.

A great result! Which was again made even better, when the business realised they could claim back significant R&D tax relief on their qualifying project costs!

If some is good, more must be better!

Some companies may just be looking for greater consistency in the finished product as was the case with a North West based industrial fabric manufacturer. The team was attempting to develop a more efficient and effective treatment and spooling process for very heavy fabric. As part of its attempts the company developed an electronic feeder system for heavy yarn to address undue wearing of gears, developing a new creel system to deliver heavy yarn from the feeder spools more efficiently and experimenting with dampeners and bearings to reduce the impact of machinery vibration on fabric tension and reduce the impact of aging yarn cones. They realised greater consistency if fabric thickness and reduced downtime from repair and maintenance AND, received a £30,000 tax benefit!

These are three quick examples of how manufacturers in the UK are using process innovation to significantly improve business efficiency, reduce costs and deliver a nice tax benefit back in to the company coffer courtesy of HMRC.

In the next of our series we will explore how a focus on “digitisation” and embracing enabling technology can improve both your efficiency and effectiveness as well as earn you valuable tax relief.

Are you missing out?

To find out how you could leverage funds back in to your business through claiming R&D tax relief on your digitisation projects…